Things about $100 Loan Instant App

Wiki Article

The Buzz on Instant Cash Advance App

Table of ContentsBest Personal Loans for BeginnersThe Ultimate Guide To Loan AppsTop Guidelines Of Instant Loan6 Easy Facts About Loan Apps DescribedInstant Loan - QuestionsThe Ultimate Guide To Best Personal Loans

When we consider obtaining finances, the images that comes to mind is people lining up in lines up, awaiting many follow-ups, and obtaining entirely disappointed. Innovation, as we recognize it, has actually changed the face of the borrowing organization. In today's economy, debtors as well as not lenders hold the key.Loan authorization and also paperwork to loan processing, every little thing is online. The lots of trusted online loan apps provide customers a system to request loans conveniently and offer approval in minutes. You can take an from several of the very best cash financing apps offered for download on Google Play Shop and Application Store.

You simply need to download and install the app or go to the Pay, Feeling website, subscribe, upload the required documents, as well as your loan will certainly get accepted. You will obtain alerted when your loan request is refined. Generally financing application utilized to take a minimum of a few days. In some cases, the loan approval utilized to obtain extended to over a month.

The Main Principles Of Instant Cash Advance App

Usually, also after getting your loan authorized, the process of getting the lending amount transferred to you can require time as well as obtain complicated. That is not the instance with on the internet funding applications that offer a straight transfer alternative. Immediate financing apps use instant personal fundings in the array of Rs.

You can obtain of an instantaneous lending as per your eligibility and also require from instantaneous loan applications. You do not have to fret the following time you want to obtain a small-ticket loan as you recognize exactly how advantageous it is to take a financing making use of on-line car loan apps.

Not known Details About $100 Loan Instant App

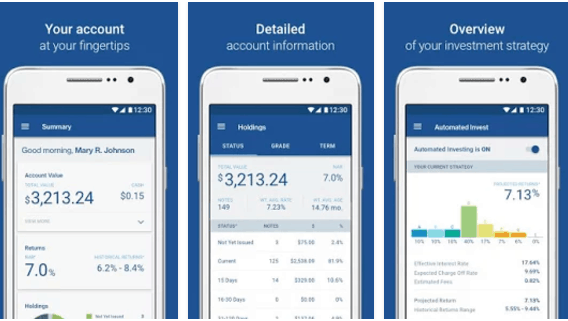

You can be sure that you'll get a sensible interest rate, period, finance amount, as well as other advantages when you take a financing with Pay, Feeling Online Financing Application.A digital lending system covers the entire financing lifecycle from application to disbursement into customers' financial institution accounts. By digitizing as well as automating the loaning process, the platform is changing standard banks into digital loan providers. In this write-up, let's discover the advantages that a digital lending platform can give the table: what remains in it for both banks as well as their customers, and also just how digital lending systems are interfering with the industry.

Every financial institution now wants whatever, consisting of financings, to be processed promptly in real-time. Consumers are no longer willing to wait for days - not to point out to leave their houses - for a car loan.

The Ultimate Guide To Instant Cash Advance App

All of their everyday tasks, consisting of monetary purchases for all their activities as well as they choose doing their monetary purchases on it also. They desire the convenience of additional reading making transactions or applying for a financing anytime from anywhere - loan apps.In this situation, electronic lending platforms act as a one-stop remedy with little hands-on data input and fast turnaround time from lending application to cash in the account. Customers ought to have the ability to relocate effortlessly from one gadget to one more to finish the application kinds, be it the internet as well as mobile interfaces.

Companies of digital loaning platforms are called for to make their products in conformity with these regulations and also assist the loan providers focus on their company just. Lenders also must see to it that the companies are updated with all the latest standards provided by the Regulators to quickly include them right into the digital lending system.

Top Guidelines Of Best Personal Loans

As time passes, electronic borrowing systems can aid save 30 to 50% overhead prices. The traditional hands-on loaning system was a pain for both lender and also consumer. It depends on human treatment as well as physical interaction at every action. Consumers had to make multiple journeys to the financial institutions as well as submit all type of documents, and also manually fill up out several kinds.The Digital Loaning system has actually altered the method banks assume regarding as well as apply their financing procurement. Financial institutions can currently deploy a fully-digital finance cycle leveraging the most up to date developments. A wonderful digital borrowing platform should have easy application entry, fast authorizations, compliant loaning procedures, and the ability to continuously boost process performance.

If you're assuming of going into borrowing, these are calming numbers. At its core, fintech is all regarding making typical economic procedures faster and also extra reliable.

$100 Loan Instant App - An Overview

One of the typical misunderstandings is that fintech applications only benefit economic institutions. The application of fintech try this web-site is now spilling from financial institutions as well as loan providers to small businesses. loan apps., CEO of the payment platform Veem, amounts it best: "Tiny services are looking to outsource intricacy to somebody else because they have sufficient to fret around.As you can see, the ease of usage covers the listing, revealing how availability and comfort given by fintech platforms stand for a big driver for customer loyalty. You can apply check this site out several fintech innovations to drive client trust fund and retention for services.

Report this wiki page